Our Investment Philosophy

With a focus on your financial well-being, we craft portfolios using proven, evidence-based strategies. Designed to reflect your goals and values, our investment approach helps you grow and safeguard your wealth with clarity and purpose.

Recognize That Markets are Efficient.

Market prices continuously incorporate new information—from economic data releases to corporate earnings announcements—making it extremely difficult for any individual investor to consistently “beat” the market. By embracing market efficiency, we focus on building a portfolio that captures broad market returns rather than chasing elusive, short-lived anomalies.

Staying Invested over the Long Term, Not by Timing the Market

Trying to leap in and out of the market in response to headlines often means missing the handful of days that drive the majority of long-term returns. Historical data show that missing the market’s very best trading days—even just ten—can cut a multi-decade return by half. A disciplined, buy-and-hold approach ensures you participate in the full upside.

Harness The Power of Compounding by Letting Markets Work For You.

Reinvested dividends and capital gains snowball over time: early gains generate additional earnings, which then earn their own returns. The longer you stay invested, the more pronounced this “growth on growth” effect becomes—turning modest annual returns into significant wealth accumulation.

Control What You Can—Fees, Taxes, and Advisor Value-Add.

While market returns lie beyond our control, fees and taxes are not. Minimizing fund expenses, implementing tax-efficient withdrawal strategies, and leveraging the quantitative value-add identified in Vanguard’s Advisor Alpha research help preserve more of your gains.

Book a Free Assessment Today

Define your financial goals with a free assessment and create a clear path toward your future. Reach out today to schedule your consultation!

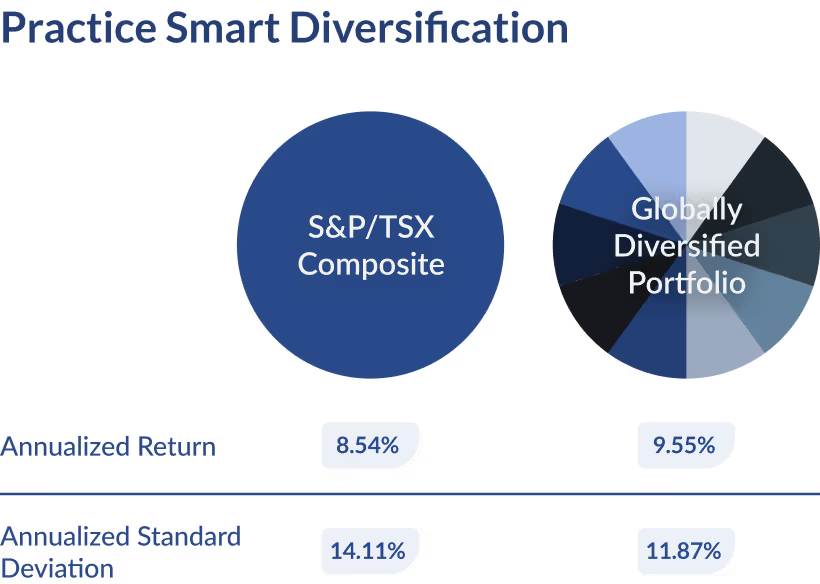

Maintain a Globally Diversified Portfolio

Spreading investments across regions, asset classes, and economic sectors reduces the impact of any one market’s downturn. Global diversification can enhance risk-adjusted returns by smoothing performance over varying market cycles.

Manage The Emotional Aspects of Investing.

Volatility is inevitable. Without a clear, written plan, investors often succumb to fear in downturns or overconfidence in rallies—behavior that undermines long-term results. Establishing predetermined rebalancing rules and communicating regularly about your goals helps keep emotions—and deviations from your strategy—in check.

Plan Proactively

A comprehensive financial plan aligns your investment strategy with life goals—whether it’s funding education, retiring comfortably, or leaving a legacy. This graphic walks through setting clear objectives, mapping cash flows, and stress-testing scenarios so you’re prepared for whatever the future holds.

Education Empowers Investors.

Offering structured financial literacy—online modules, interactive workshops, and one-on-one consultations—ensures every family member, from teens learning budgeting basics to retirees managing legacy assets, speaks the same language. By demystifying concepts like compounding, diversification, and tax efficiency, you foster open dialogue, strengthen intergenerational communication, and safeguard your family’s financial legacy for generations to come.

Book a Free Assessment Today

Ready to get started? Let’s define your financial goals with a free assessment and create a clear path toward your future. Reach out today to schedule your consultation!